Mutual fund «Halyk-Valyutnyi»

Opportunity not only to save your funds,

but also to increase them by investing in currency fund

but also to increase them by investing in currency fund

29 january 2026

Unit price

$ 1 116.29716

Mutual Investment Fund (Mutual Fund) - a fund that collects assets

of investors (unitholders) for joint investments.

of investors (unitholders) for joint investments.

Advantages of “Halyk-Valyutnyi” mutual fund

Units purchase, buyback,

dividend payments

are made in USD

dividend payments

are made in USD

Asset manager

with over 8 years of successful

asset management experience

with over 8 years of successful

asset management experience

Halyk Finance has

international rating Fitch

(«BBB-»)

international rating Fitch

(«BBB-»)

Initial minimum investment -

USD 1 000

and above

USD 1 000

and above

Main features of Halyk-Valyutnyi

- Initilal investment size – starting from USD 1 000

- Fund portofolio contains eurobonds of kazakstan and foreign emitters, ETF

- Quarterly buyback – January 25, April 25, July 25, October 25

- Monthly reports and consultations

- Unit price

- The yield calculation methodology

The shares of mutual fund Halyk-Valyutnyi is registered by the National Bank of the Republic of Kazakhstan on 08.12.2015. The value of units may increase or decrease. Past investment results do not determine future returns. The state does not guarantee the return on investment in investment funds.

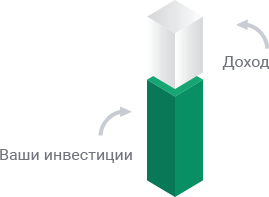

The benefits of collective investment

|

Risk reduction due to diversification Due to the size, mutual funds can invest in dozens of instruments. This means that if one of the assets shows weak dynamics, the value of the mutual fund will change slightly. |

Professional management Management companies have access to all sources of information. The company automatically tracks all investment risks.

|

Decreased expenses Trust management removes from the expenses list of investor - the Kazakhstan broker service fee - one of the elements of commissions. Additionaly to that, analytical platforms and exesting trading lines with many brokers allow Halyk Finance to achieve execution at best prices that are inaccessible to independent investors. |

How it works?

1

Investor buys units and becomes the unitholder of the Fund

2

Unitholders' money is accumulated in the fund and invested in financial instruments according to the fund’s strategy

3

A change in the value of the fund assets affects the value of the unit, and the difference in the purchase price and sale price constitutes the investor's profit or loss.

Do you have any questions?

Get free consultation of our managers