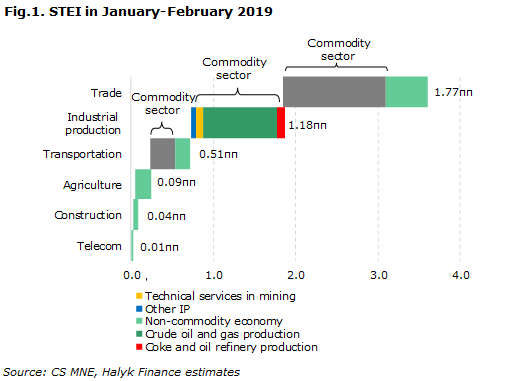

Since the beginning of the year, domestic trade (wholesale and retail) that grew 7.6% yoy (+ 2.0% yoy 2M2017, + 7.0% yoy 2M2018), transportation by 4.4% yoy (+ 3.2% 2M2017, 4.4% yoy 2M2018) and agriculture by 3.6% yoy (+ 1.6% 2M2017, + 3.3% yoy 2M2018) contributed the most to the STEI.

Industrial production grew 2.7% yoy and as compared with 2M2017 (+ 4.5% yoy) and 1M2018 (+ 5.6% yoy) remains the lowest metrics in the last three years. Construction in January-February 2019, reached a positive zone and amounted to 2% yoy (-4.5% yoy 2M2018, + 5.3% yoy 2M2017). Telecommunication sector in January-February of this year made 0.5% yoy (+ 0.2% yoy 2M2017, + 5.7% yoy 2M2018).

According to the Committee on Statistics of the Ministry of National Economy of Kazakhstan (the CS MNE), in January-February 2019, industrial output amounted to T4.385bn in current prices, which is 2.7% yoy (+ 4.5% yoy 2M2017, + 5.6% yoy 2M2018) than in the same period last year. According to our estimation, industrial production contributed 1.18pp and shared 32.8% of growth.

In mining and quarrying of Kazakhstan's industry, output in January-February 2019 increased by 6.3% yoy (+ 5.5% yoy in January-February 2018). Crude oil output in January-February 2019 made 4.3% yoy (+ 7.2% yoy in January-February 2018). According to the CS MNE, crude oil and natural gas output in January-February 2019 accounted for 15 278 thousand tons (14 662 thousand tons in January-February 2018), which is 17.1% of the targeted output for 2019 (89.5 million tons targeted of the Ministry of Energy of the Republic of Kazakhstan). Within mining of metal ores, there is a multidirectional growth trend depending on metal ore type. Thus, non-ferrous ores mining reached 16.8% yoy (0.1% yoy in January-February 2018), while iron ore output made -2.2% yoy (+3.9% yoy in January-February 2018).

Crude oil and natural gas contribution to the STEI, according to our calculations, in January-February 2019 amounted to 0.87pp. Commodity sector contribution to the STEI, including taking into account the transportation and sales of commodity sector products, was 2.58pp, which is about 72% growth.

Manufacturing in the reporting period of 2019 made -2.3% yoy. (+ 6.1% yoy in January-February 2018). Within manufacturing, the two-digit increase in production is still demonstrated by the light industry sector of 24.1% yoy (2.4% yoy in January-February 2018), beverage industry 14.6% yoy (+ 10.7% yoy in January-February 2018) and rubber and plastic products production industry 18.7% yoy (+ 8.5% yoy in January-February 2018). The increase in chemical products industry in the period amounted to 10.5% yoy (+ 14.2% in January-February 2018), machine-building 9.5% yoy (+ 8.8% in January-February 2018), basic precious and non-ferrous metals output 3.5% yoy (+4.6 yoy in January-February 2018) and the production of coke and oil refined products 4.9% (+2.4% in January-February 2018). Metallurgy showed negative growth of -9.6% yoy in the period (+ 6.0% yoy in January-February 2018). Ferrous metallurgy accounted for -25.5% in January-February (+ 7.7% yoy in January-February 2018).

Domestic trade made 7.6% yoy in January-February of 2019 with retail sales of 4.0% yoy (+ 4.1% yoy in January-February 2018), and wholesale 8.4% yoy (+ 8.6% yoy in January-February 2018). According to our calculations, trade contributed to the STEI 1.77pp in January-February 2019. The share of commodity sector in domestic trade (including wholesale and retail trade in oil and oil products, metals and products from them), according to our current estimate, is at least 70% of the total.

Transportation ensured a 0.51pp increase in the STEI in January-February 2019 and amounted to 4.4% yoy (4.4% yoy January-February 2018). Positive dynamics of freight turnover was in air transportation 79.4% yoy, in automobile transportation 6.0% yoy and in railroad 2.7% yoy. In transportation by pipelines, freight turnover increased (+ 1.2% yoy) due to an increase in gas transmission by (+ 5.0% yoy) and a reduction in oil transmission (-1.9% yoy). Freight turnover by sea was negative and made -45% yoy. Transportation of commodity sector products by all modes of transport, according to our estimates, is at least 75% of the total cargo transportation.

Output of agriculture in January-February 2019 was 3.6% yoy (+ 3.3% yoy in January-February 2018). The contribution of agriculture to the STEI in January-February 2019 amounted to 0.09pp.

Construction sector grew in January-February 2019 was 2.0% yoy (-4.5% yoy January-February 2018). The contribution of construction to the STEI in the analyzed period was 0.04pp.

Telecommunication sector contributed to the STEI the least and made 0.01pp in January-February of the current year, evidencing the growth rate of 0.5% yoy (+ 5.7% yoy January-February 2018).

Fixed assets investments in January-February 2019, according to the preliminary data of the CS MNE, was 4.2% yoy (+ 54.4% yoy in 2M2018). In nominal terms, investments in fixed assets reached T1.284bn within the analyzed period.

Our opinion

In January – February of this year, all the components of the STEI evinced a growth. Domestic trade, industrial production and transportation contributed the most to the indicator. In January-February, there was a gradual recovery in industrial production to 2.7% yoy.

Analysis of the monthly growth dynamics of all STEI components evidenced that industrial production (+ 1% mom) and construction (+ 83% mom) were positive, while the rest still show a negative growth trend. The monthly indicator of STEI in -February of the current year leveled at 2.3%.

Analysis of the statistics of the first months of this year evidences that manufacturing is gradually reducing the negative dynamics, but is still negative. In manufacturing, metallurgy (as a commodity sector primary processing industry) shows a reduction in the negative dynamics of growth in the analyzed period (especially in the ferrous metallurgy sector). We associate improvement in the dynamics primarily with the gradual restoration of production at JSC “ArcelorMittal Temirtau”, the failure of which occurred in November of last year. According to the results of the first quarter 2019, the company plans to reach production volumes at the level of last year. Mining of non-ferrous metal ores, growth in technical services in the field of the mining industry supported the growth of mining industry. Note that in the first half of the year, production at the largest oil fields is planned to stop for a maintenance services for one or one and a half months, which will affect the growth rate of industrial production in the country as a whole. Decline in commodity sector of the economy will affect secondary manufacturing industries (metallurgy, coke and petrochemicals, rubber and plastic products, etc.) that, according to our current forecast round is expected at 1.8% in 2019. Domestic trade, which continues to make a significant contribution to economic growth over the past two months and is ahead of industrial production in January-February 2019, will support economic growth in 2019. However, taking into account that commodity sector in domestic trade, in our estimation, is circa 70%, then domestic trade will also experience the negative impact of the upcoming slowdown in commodity sector of the economy.

According to our current projections, the economy will make 3.6% yoy and household consumption and government spending will render the most to its growth.