There has been a record economic growth over the past six years at 4.5% in 2019. The growth of Kazakhstan's economy in 2019 significantly exceeded analysts' expectations - the consensus forecast for GDP growth was below 4%. The economy began 2019 with growth of less than 4% in the first quarter, but accelerated to almost 5% in the last quarter. The increase in government spending to 20.4% of GDP (+1.6pp per year) gave a fresh impetus to economic growth, which, in parallel with the continued increase in demand for retail loans, fueled increased consumption and increased investment. Since 2009, annual economic growth averaged 4.2% and was accompanied by injections from the National Fund at the level of 5.3% of GDP annually.

Agriculture showed the worst dynamics among all sectors of the economy. In construction, growth was almost +13%, trade +7.6%, telecommunications +5.2%, transport +5.1%, industrial production almost +4%. The outsider among the sectors is agriculture, where a weak crop has led to a slowdown in growth from 3.4% to about 1%. Oil prices last year were quite comfortable for the economy, although they dipped 10% to $64 per barrel, but were above $50 on average in 2015-2017.

Domestic consumption has maintained high growth rates - investment +8.5%, retail sales +5.8%. The primary sector, energy and housing construction were the main drivers of investment in fixed assets. Numerous fiscal and administrative incentives aimed at increasing household incomes, as well as continued growth in retail lending, had a positive effect on consumer activity. However, their effect was offset by increased demand for foreign currency by the population and weaker economic growth in some regions.

Salaries grew by 14.5% yoy in nominal terms, inflation by 5.4% yoy in 2019. Due to increased budget spending and a 50% increase in salaries in 2019, real wages increased by about 9% yoy. Such strong growth has not been observed since 2012, which, among other things, paved the way for increased inflation expectations. Last year, the main contribution to inflation was made by food products (40% in the price index) with an increase of almost 10% per year, which offset the impact of lower tariffs on services. This year, without another intervention by the state, the effect of a loose coil spring can be realized, provoking a new wave of price increases. State intervention in pricing process in 2019 had a temporary effect - the costs were shifted to state monopolies.

The current account deficit for 9M2019 expanded to $ 4.3bn from $ 1.8bn for 9M2018. According to updated NBK data, the current account negative balance of $ 1.4bn increased in the second quarter of 2019 to $ 2.8bn in the third. The expansion of the current account deficit for 9 months of 2019 was facilitated by a decrease in the trade surplus of 19.3% yoy to $ 15bn. At the same time, export volumes decreased by 2.0% yoy to $ 42.8bn, while import volumes grew by 10.8% yoy to $ 27.8bn. Within the financial account, there is a significant outflow of capital in the amount of $ 2.1bn, which is 19.5% more than the outflow of capital for the same period in 2018. Such dynamics was facilitated by an increase in capital outflow in the first quarter of 2019 in the amount of $ 3.5bn. The inflow of capital in the account for the 9 months of last year was facilitated by the inflow in the third quarter of 2019 of $ 1.4bn due to the placement of Eurobonds in September and the influx of foreign investment.

The national currency rate followed oil prices. At the end of the fourth quarter, the national currency strengthened by 0.8% yoy to 381.2 tenge per US dollar. However, this strengthening was mainly the result of the last month of the year due to the simultaneous influence of the growth of oil quotes in global markets and tax payments within the country. During the year, the national currency rate remained at levels significantly higher. This was facilitated by the negative background associated with trade disagreements between the US and China, unstable oil prices, and during the year, non-residents invested in TK financial instruments from T125.2bn at the end of January to T53.6bn at the beginning of December 2019. The national currency rate against the Russian ruble updated its minimum at 6.04 tenge per ruble at the end of June 2019, when the Russian ruble appreciated against the US dollar to 62.58 rubles. At the end of the year, the quotation for the RUBKZT pair reached its minimum at 6.17 tenge per Russian ruble, when the ruble against the dollar updated its second annual maximum, strengthening to 61.84 rubles per US dollar.

Monetary conditions, despite the absence of changes in the base rate, have become weakly restraining. After raising the base rate to 9.25% in September under pressure from inflation in food prices, expanding domestic demand and volatility in global oil markets, uncertainties due to trade disagreements between the US and China, the regulator assessed monetary conditions as neutral. At subsequent meetings in 2019, the regulator did not change the base rate, however, in a press release last year, it noted that monetary conditions are weakly constraining. At the same time, rates on money market instruments continued to move up while reducing the volume of operations. Since the summer of 2019, there has been an increase in the yield on instruments on the money market with maturities of 6-12 months, which, in our opinion, is caused by the NBK efforts to move liquidity to a longer time, on the one hand, and the withdrawal of free liquidity from the foreign exchange market in order to reduce speculative component. The upward movement of rates was also facilitated by the demand for the national currency, especially during tax payments (in August and December). The average annual currency swap rates and money market rates approximate to each other and vary in a narrow range of 10.05% -10.16%. In addition, this approximation occurs against the background of a shrinking, but still persisting excess liquidity.

The international reserves of the NBK decreased by 6.4%, while the share of gold increased to 65%. Consolidated international reserves at the end of 2019, according to updated NBK data, amounted to $ 90.9bn. Since the beginning of the year, consolidated reserves increased by 2.2% mainly due to an increase in the volume of assets of the National Fund by 6.8% to $ 61.9bn, while gross gold and foreign currency reserves of the National Bank of the Republic of Kazakhstan decreased by 6.4% and amounted to $ 29.0bn. As part of the NBK reserves, there is a decrease in the most liquid part of gold reserves, assets in hard currency, the volume of which has decreased by 39.0% since the beginning of the year (by $ 6.5bn) to $ 10.1bn. Gold in the NBK's asset structure grew by 31.2% beginning of the year and amounted to $ 18.9bn, or 65.0% of the gross volume of international reserves of the NBK. The increase in the value of gold from $ 1,464 in November to $ 1,517 at the end of December affected the nominal revaluation of this asset in December by 5.5% mom.

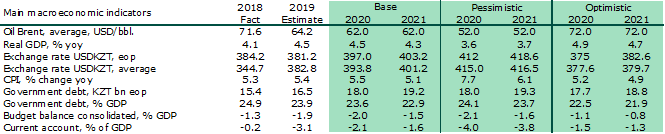

In the base case, according to the results of 2020, we expect GDP growth of 4.5%, inflation of 5.5% and weakening of the tenge by 4%. The global oil market remains under considerable supply of reserves and the expected increase in oil production in countries outside of OPEC, and it continues to put pressure on prices for hydrocarbons. Accordingly, our forecast for oil prices this year remained at $62 per barrel (-3.4% yoy). Thanks to numerous government measures to stimulate consumption, domestic demand in the Kazakhstan’s economy largely compensates for the deterioration of the external environment and supports economic growth in the short term. As a result of accelerating economic growth within the current business cycle, it is possible that it will increase slightly this year, but further growth will come against structural constraints. The risks of accelerating consumer inflation under the influence of increasing budget expenditures, accompanied by a depreciation of tenge, will to a certain extent depend on the effectiveness of government agencies in containing prices. According to our baseline scenario, the forecast for GDP growth in 2020 is 4.5%, expectations for the tenge against the US dollar were maintained at 397 at the end of this year, which implies a weakening of 4% from the beginning of the year. We implemented the scenario forecasts of the main macroeconomic indicators for 2020 with a symmetrical deviation from the baseline scenario, which assumes an average annual oil price of $62 per barrel in 2020.