Economic growth accelerated to 4.6% yoy in the third quarter due to government spending. The growth of the economy of Kazakhstan this year was headed for a gradual acceleration, amounting to 3.8% yoy in the first quarter, 4.4% yoy in the second and 4.6% yoy in the third. The latter indicator corresponds to the level of 2014, when the oil price was close to $100 per barrel. However, the average level of oil prices for 9M2019 amounted to about $65 per barrel, which is 11% lower than the same indicator a year earlier. At the same time, oil production also decreased slightly against the background of maintenance works at the country's largest oil fields. Accelerated economic growth amid falling oil prices is explained by the increase in government spending, which increased by almost 20% yoy – the highest growth since 2012. It should be noted that the financing of these expenditures is carried out at the expense of the same oil revenues accumulated in the National Fund earlier. Among major industries, no fundamental changes took place against the background of a large volume of investments, the sectors of construction, trade and transport were actively growing. Against this background, a slowdown in industrial output has been evident as part of the general global trend due to declining demand for raw materials and finished goods.

Agriculture is a weak chain in the Kazakhstan economy. The only industry that finished the reporting period in the negative zone was agriculture. A weak grains crop has taken agriculture to the negative zone for the first time since 2013, although for the year as a whole the situation may improve due to the small decrease at the moment by 0.5% yoy.

The increase in real wages in the public sector offset the decline in the private sector. The average salary in September of this year amounted to almost T189 thousand, which is T28 thousand or 17% higher than in September 2018. At the same time, retail trade showed a slowdown to 5.5% from 7% a year earlier amid increasing demand for foreign currency. Consumer lending growth is still above 20% yoy.

Inflation risks are not fully realized. High devaluation expectations of the population and the weakening of the national currency by more than 10% yoy compared to the same period last year did not have a corresponding reflection in the data of official statistics on the consumer price index. Inflation for 9M2019 remained at the level of last year at 3.3%. While the weakening of the tenge against the US dollar in January-September of the current year amounted to almost 12% yoy, and the similar change to the ruble amounted to more than 6% yoy, the contribution of non-food products to inflation, on the contrary, decreased.

The current account deficit in 1H2019 expanded to $1.9bn compared to $1.5bn in 1H2018. According to the updated NBK data, a small negative current account balance of $163mn in the first quarter of 2019 was covered by a deficit of $ 1.757mn in the second quarter. The expansion of the current account deficit was facilitated by a decrease in the trade surplus of 7.5% yoy to $11.4bn. At the same time, the nominal export volume grew by 0.8% yoy and amounted to $ 28.3 billion, while the volume imports grew by 7.2% yoy and amounted to $16.0bn. The reduction in the deficit in the balance of services by 6.7% yoy and primary income by 3.6% yoy in the first half prevented a widening of the current account deficit.

The national currency follows the decline in oil prices. In the third quarter, the national currency weakened by 1.4% from an average of 380.9 tenge in the second quarter to 386.1 tenge per dollar in the third. Kazakhstan tenge followed oil quotes, which in August almost approached their annual lows of $56.2 per barrel (54.9 at the beginning of the year). Also, as in the second quarter of 2019, in the third quarter, the Kazakhstan tenge continued to experience the influence of a drop in oil prices against the background of the greater stability of the Russian ruble against the US dollar. This, in turn, shifted the quotation for the RUBKZT pair to an annual maximum of 6.07 tenge (6.12 tenge per Russian ruble at the end of October).

Monetary conditions, despite an increase in the base rate, remain neutral. In September of this year, the regulator decided to raise the base rate to 9.25%, attributing such a decision to food inflation, expanding domestic demand and price volatility in global oil markets, as well as uncertainty due to trade differences between the US and China and a slowdown in the global economy. Rates on money market instruments continue to move up. The yield on short-term notes with a maturity of 182-364 days increased to 10.00% -10.20%. The weighted average yield was 9.31% in August of the current year (9.02% in June 2019 and 8.61% in August last year). The actions of the regulator will restrain the flow of funds into the real sector of the economy due to the cost of credit, which in turn will reduce the inflationary pressure on the economy. In addition, an increase in interest rates on money market instruments with a maturity of 6-12 months will facilitate the further transfer of large volumes of liquidity to longer periods.

The international reserves of the NBK decreased by 7%, while the share of gold increased to 63%. According to preliminary data from the NBK, the consolidated international reserves of Kazakhstan in September 2019 amounted to $ 88.1 billion, having decreased by 0.9% since the beginning of the year due to a decrease in the NBR gold reserves by 6.9% to $ 28.8 billion. The NBK has experienced a decrease in the most liquid part of gold reserves - since the beginning of the year, assets in hard currency decreased by 35.0% to $ 10.7 billion, although over the past month they have grown by 12.0%. The volume of gold in the reserves of the NBK as of the end of September this year increased by 25.5% from the beginning of the year to $ 18.1 billion, or 62.7% of the total gold reserves. At the end of September of this year, the assets of the National Fund (NF) increased by 2.3% from the beginning of the year and reached $59.3bn. Direct tax revenues from enterprises of the oil sector increased by 0.7% YoY and amounted to T2.128bn.

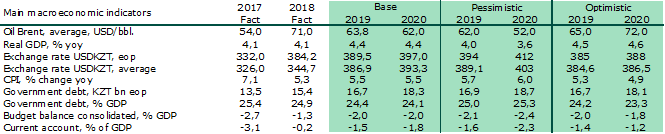

In the base scenario, we expect GDP to grow by 4.4% by the end of 2019, inflation at 5.5%, and the national currency rate at - 389.5 tenge per dollar. As a result of escalation of trade disagreements between the largest economies – the United States and China, lasting for the second year, and the growth of uncertainty about the actions of world central banks that could spill over into currency wars, a slowdown in global economic growth is expected. In particular, in October, the IMF once again lowered its forecast for global economic growth for 2019 from 3.3% to 3%. Quotations of “black gold” this year are extremely weakly responsive to reduced production under OPEC+ agreements and geopolitical instability in important oil-producing countries, indicating a weakening demand. Accordingly, our expectations for oil prices are shifting down from $65 to $63.8 barrel this year.

Thanks to numerous government measures to stimulate consumption, domestic demand in the Kazakhstani economy largely compensates for the deterioration of the external environment and supports economic growth in the short term. The risks of accelerating price growth in the consumer market under the influence of increasing budget expenditures, accompanied by a depreciation of tenge, stubbornly do not want to materialize fully in the growth of inflation so far. The forecast for GDP growth in 2019 and 2020 was 4.4%. Expectations of the tenge exchange rate to US dollar were revised downward from 385 to 389.5 at the end of this year (baseline scenario). We implemented the scenario forecasts of the main macroeconomic indicators for 2020 with a symmetrical deviation from the baseline scenario, assuming an average annual oil price of $62 per barrel in 2020.