The economy has maintained growth rates above 4%, despite declining production volumes and oil prices. The growth of the economy of Kazakhstan in the first half of 2019 slowed down slightly to 4.1% from 4.2% in 1H2018, while in April-June, the economic growth was about 4.4% yoy the highest since the 2nd quarter of 2017. The average level of oil prices decreased by 7% yoy to $66 per barrel in 1H2019, and production decreased by 2% yoy to 44.3 million tons. From a sectoral perspective, a slowdown in industry and agriculture is evident, while the transport sector, trade, and construction have been a significant drivers of economic growth. In the first half of the year, there was also a strong growth of investments in fixed assets in the amount of 11.7% yoy, however, according to our estimates, the share of raw materials industry in the growth of all investments amounted to almost 100%. After spring scheduled maintenance at Kashagan a planned shutdown of oil production at the largest oil field in Kazakhstan - Tengiz is expected this fall, the production volumes of which are twice as high compared to Kashagan. In addition, scheduled repairs will also be carried out on Karachaganak. As a result, according to the results of the current year, oil production will drop to 89 million tons from 91 million tons in the past year, which will negatively affect the performance of industry and exports. The effect of stops at the three largest fields of the country and unfavorable external conditions in the current year will be smoothed out by an increase in government spending to 20.5% of GDP from 19% of GDP in 2018.

The current account deficit in the first half of 2019 expanded to $2bn, and there was also capital outflow on the financial account by $4bn. According to preliminary data from the NBK, a positive account balance of $361mn in the first quarter of 2019 was covered by a deficit of $2,347mn. in the second one. The expansion of the current account deficit was facilitated by a decrease in the trade balance by 10.3% yoy $11.3bn. At the same time, the nominal export volume grew by 1.1% yoy and amounted to $28.5bn, while imports increased by 10.2% yoy and amounted to $17.3bn. The widening of the deficit in the balance of services account in the first half of this year by 13.9% yoy to $2.2bn also contributed to the expansion of the current account deficit. According to the financial account, there was an outflow for two consecutive quarters and for the first half of 2019 amounted to $4bn. Thus, according to the country's external accounts, the total outflow amounted to about $6bn.

Growing inflationary pressures and an increase in the share of the National Fund transfers in the budget revenue amid falling revenues from other sources. In the first half of 2019, despite the reduction in tariffs, inflation accelerated to a similar level a year earlier at 2.6%. Pressure on the consumer market is created by the weakening of the national currency, high inflationary and devaluation expectations of the population, increased inflationary budget expenditures and external factors. The revenue flow of the state budget for six months of this year is worse than in the last three years, against which the share of transfers of the National Fund increased to 29% of all revenues. The state budget deficit in January-June expanded to -T112 billion from -T79 billion in the same period in 2018, but is within the planned limits. The use of the National Fund in 1H2019 exceeded the receipt of funds.

Growth of demand for consumer loans and real wages amid unprecedented government measures to reduce the debt burden of the population. Consumer lending, which showed double-digit growth in real terms in the first quarter, began to show an increase in activity in the second (13.4% yoy vs. 14.1% yoy). The labor market experienced a slight weakening in demand for labor, the number of employees at the end of June amounted to 8.8 million. Real wage growth was around 7.4% yoy. Together with an increase in demand for consumer loans, this stimulates trade turnover, showing growth above 5%.

Amid a slowdown in the global economy, the national currency of Kazakhstan will remain at approximately current levels to stimulate Kazakhstani exports. Despite lower oil prices, the exchange rate of the tenge in the first half of the year was on average at 379 per US dollar, while against the Russian currency it weakened by 8% to 6.1 per ruble, although the Russian economy did not demonstrate a faster pace of economic growth. “Weaker” tenge until the end of the year will contribute to a better execution of the state budget, which was made up based on 370 tenge per dollar and 55 dollars per barrel of oil. Maintaining a balance of interests of the external (exporters) and domestic sector (population), the NBK will most likely refrain from a significant weakening of the national currency, provided that there is no significant “drawdown” in oil quotes.

Monetary conditions, despite the reduction in the base rate, remained neutral. In the second half of June this year, the NBK placed short-term notes at rates of return (about 9.5-10%) significantly higher than previous placements (8.7% -9.0%). The shift in rates of return occurred by 0.7% -1.0% up. At the same time, money market rates formed at the level of the lower boundary of the base rate corridor. The actions of the NBK in terms of increasing the yield on its instruments without tightening monetary conditions by raising the base rate are aimed at moving excess volumes of liquidity from short placement terms to more distant ones.

International reserves. Gold holdings reached a share of 60.4% of international reserves, which fell by almost 9%. According to the NBK, the consolidated international reserves of Kazakhstan in June 2019 amounted to $88.2bn, having decreased by 2.8% since the beginning of the year due to a decrease in the NBR gold reserves by 8.8% to $28.2bn, the size of the National Fund increased by 3.4% to $60.0bn. The NBK significantly reduced its holdings in securities from $10.1bn at the beginning of the year to $7.2bn in June (-29.5%), as well as in foreign currency and deposits by 42.4% to $3.2bn. In the structure of NBK assets, the volume of gold in nominal terms increased by 18.5% from the beginning of the year and amounted to $17.1bn or 60.4% (the maximum value for the entire observation period). In June, the revenue of funds in the NF increased 3.2 times in annual terms and amounted to T1.952bn or $5.1bn (+ 32.5% m / m). Direct tax revenues from oil companies increased by 10.5% yoy to T1.516bn.

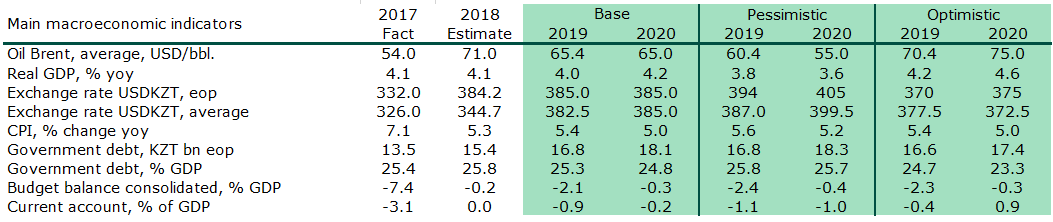

In the base case we expect GDP growth of 4% in 2019, inflation at 5.4%, and the national currency rate - 385 tenge per dollar at the end of the year. As a result of the escalation of trade disputes of the largest countries and the growth of uncertainty regarding the further actions of world central banks, a slowdown in global economic growth is expected. In particular, the IMF lowered its forecast for global economic growth to 3.2%, and global trade growth to 2.5%. Quotations of black gold react extremely weak to reduced production under OPEC + agreements and growing geopolitical risks (hijacking of tankers, instability in individual oil-producing countries), which may indicate weakening demand. Accordingly, our expectations for oil prices are shifting down from $68 to $65.4 per barrel this year. Thanks to numerous government measures to stimulate consumption, domestic demand in the economy of Kazakhstan compensates for the weak external environment and will support economic growth. At the same time, we see the risks of a more significant increase in consumer prices as a side effect of a sharp increase in social spending with a parallel depreciation of tenge. The forecast for GDP growth was increased from 3.6% in 2019 and 2020 to 4% and 4.2%, respectively. The forecast for the tenge exchange rate at the end of this and the next year against the US dollar was revised downward from 375 to 385 (baseline scenario). We implemented scenario forecasts of the main macroeconomic indicators with a symmetrical deviation from the baseline scenario, assuming an average annual oil price of $65.4 per barrel in 2019 and $65 per barrel in 2020. Pessimistic - the average annual price of $60.4 per barrel in 2019 and $55 per barrel in 2020, optimistic - the average annual oil price of $70.4 per barrel in 2019 and $75 per barrel in 2020.