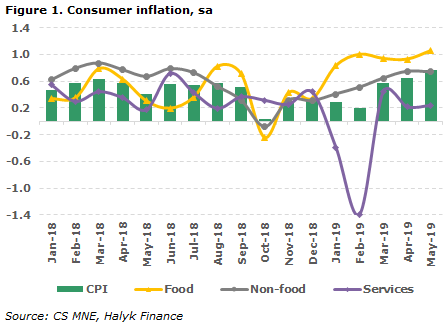

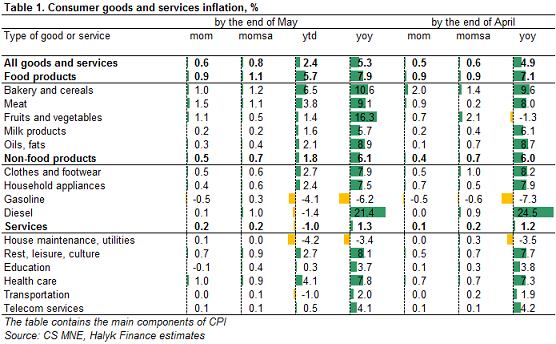

According to the Statistics Committee, inflation accelerated in May to 0.5% from 0.4% in April. In annual terms, it returned to the level of 5.3% after being below 5% for three months in a row. Taking into account the seasonal adjustment (sa), by our estimate, inflation was 0.8% mom. The rise in prices is widespread with a parallel weakening of the national currency, the administrative reduction of tariffs of state monopolies had a short-term effect and now the costs of services is rising again.

In the group of food products, inflation in May did not change, amounting to 0.9%, 1.1% mom sa, providing 0.35pp in total inflation. High price increases are supported by bakery products and cereals, which grew by 1.0% mom, bread went up by 0.8% mom, pasta products by 0.9% mom, meat up by 1.5% mom, fruits and vegetables for the month added 1.1% mom. Prices for eggs decreased (-3.3% mom), cottage cheese (-0.7% mom), milk (-0.2% mom).

Prices for non-food products increased by 0.5% mom (0.7% mom sa), the contribution of 0.15pp to inflation. The cost of household goods (+0.6% mom), medicines (+0.7% mom), clothing and footwear (+0.5% mom). Gasoline has fallen in price by 0.5% mom, diesel fuel has risen by 0.1% mom.

In the service sector, tariffs increased by 0.2% mom (+0.2% mom sa), with a 0.06pp contribution to price changes. The main factors of increase: health care (+1% mom), personal services (+0.9% mom), recreation and entertainment (+0.7% mom). Fell cheaper services of railway transport, education services.

The results of population polls for April, published by the NBK, showed a slight decrease in inflation expectations with an increase in devaluation expectations. The share of respondents who expect price growth to accelerate in the next 12 months decreased to 18.6% in April, after 18.8% in March (20.4% in April 2018, 28.2% at its peak in September 2018). The share of respondents expecting a decline or unchanged price position increased to the previous month to 9.6% after 9% in March (8.7% in April 2018), with a minimum of 5.8% in October 2018. In April 2019 the share of respondents who expected a weakening of tenge rose to 65.3%, compared with 63.6% in the previous month (48.1% in April 2018), which is below 70.7% at its peak in September 2018. Meanwhile, the amount of net expenses (KZT365.5 billion) of population for the purchase of cash dollars in January-April increased by 31% compared with the same period of 2018.

Our opinion

The rise in prices for food products remains at an elevated level in comparison with the same period last year and is due to the rise in prices for agricultural products on foreign markets, with a positive increase in imports. The prices for non-food products are still very weakly reflecting the effect of a weakening of national currency, for example, against the US dollar the tenge depreciated by 2% from the beginning of the year and by 14.5% from May 2018, to the ruble in the same period the depreciation was 6% and 10% respectively. Administrative regulation of state monopoly tariffs and the control of prices for fuel and lubricants, which resulted in a short-term slowdown in inflation at the beginning of the year, in our opinion, creates the risk of a significant increase in prices in the perspective of the coming year when their containment will be economically unacceptable. In addition, the increase in wages and social benefits, double-digit growth in consumer lending, high inflation expectations set the stage for pro-inflation factors. At the last meeting on June 3, the National Bank predictably left the base rate unchanged, which in our opinion is the right decision in terms of accumulation of inflation risks and turbulence in foreign markets due to the slowdown of leading economies of the world since the second half of 2018 and geopolitical tensions.