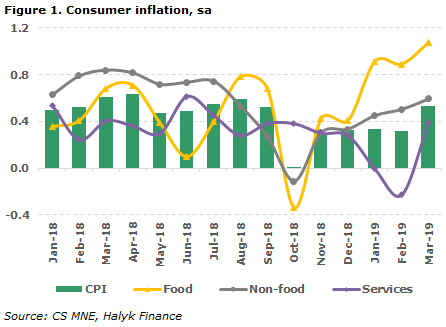

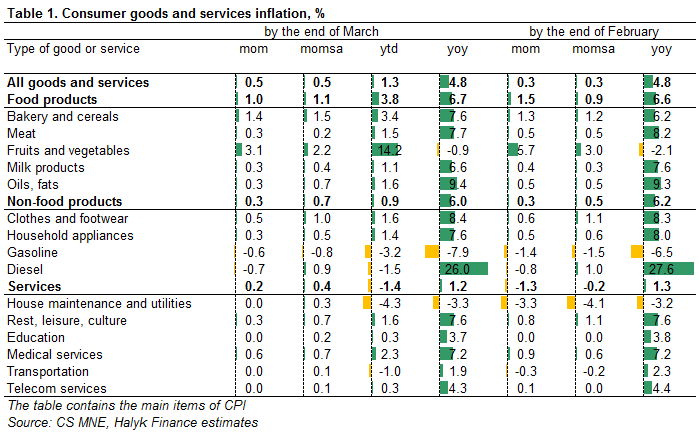

According to the Statistics Committee, inflation accelerated in March to 0.5% compared to 0.3% in February and corresponds to 0.5% in March 2018. In annual terms, the value has not changed from 4.8%. Taking into account the seasonal adjustment (sa), by our estimate, inflation was 0.5% mom. The main contribution to the acceleration of growth in prices was made by food products, which are at a high level, showing growth of at least 1% for the fifth consecutive month.

In the group of food products, in March, inflation slowed down to 1%, 1.1% mom sa, providing 0.4pp in total inflation. High price increases are supported by the seasonal rise in prices for vegetables, which added 5.5% mom over the past month, due to cabbage (+26.1% mom), onions (+15.2% mom), in addition bakery products and cereals increased by 1.4% mom, bread went up by 2.4% mom, pasta increased by 1.7% mom. Prices for eggs decreased (-1.3% mom), sour milk (-0.2% mom), cottage cheese (-0.8% mom).

Prices for non-food products increased by 0.3% mom (0.6% mom sa), the contribution of 0.09pp in inflation. The cost of household goods increased (+0.5% mom), medicines (+0.7% mom), clothing and footwear (+0.5% mom). Gasoline prices fell 0.6% mom, diesel fuel 0.7% mom.

In the services sector, tariffs increased by 0.2% mom (+0.4% mo m sa), with a 0.06pp contribution to price changes. The main factors for the increase are: healthcare (+0.6% mom), transport (+0.3% mom), hotels and restaurants (+ 0.5% m / m).

The results of population polls for February, published by the NBK, showed a sharp increase in inflation expectations with a parallel increase in devaluation expectations. The share of respondents who expect price growth to accelerate in the next 12 months showed an increase after a continuous decline from a peak in September 2018 to 17.8% in February (15.9% in February 2018) and 28.2% in September 2018. The share of respondents expecting a decline or unchanged price position slightly declined to the previous month to 9.8% (8.6% in February 2018), with a minimum of 5.8% in October 2018. In February 2018, the share of respondents who expected US dollar appreciation increased to a maximum since September 2018, at 68% (44.2% in February 2018), which is slightly lower than 70.7% at its peak in September 2018. The amount of expenses (T116.3 billion) population directed for the purchase of cash dollars increased by 23% in February compared with January and almost 70% in annual terms, while the National Bank’s foreign exchange assets fell to a minimum since the end of 2006 to approximately $14 billion.

Our opinion

The behavior of prices in the consumer market testifies to a small response from the prices for the planned stimulation of consumer demand at the expense of the state budget and extra-budgetary funds, however, inflation and devaluation expectations of the population increased tangibly. Food prices increase remain high. The prices for non-food products do not yet react to the dynamics of the tenge exchange rate against other currencies, which is at historic highs around 380 to $ and 5.7 to the ruble. Small growth in the services sector is mainly determined by the private sector, while the tariffs of state monopolies are strongly constrained.

In the first quarter of 2019, inflation has increased by 1.3% since the beginning of the year, compared with 1.8% in the same period last year. At the same time, we estimate the contribution of the administrative factor in regulating tariffs of state monopolies at around 1% in the first quarter, which led to an unusually strong slowdown in inflation. This indicates the presence of hidden risks in the consumer market, due to its artificial suppression. This is also indicated by the National Bank itself, that is awaiting the manifestation of inflation next year, when the effect of tariff reduction stops. Due to the continuing risks of accelerating price growth in response to higher wages, social benefits and subsidized interest rates, we do not expect changes in monetary policy in the near future.