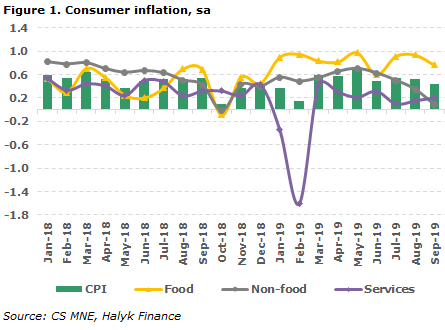

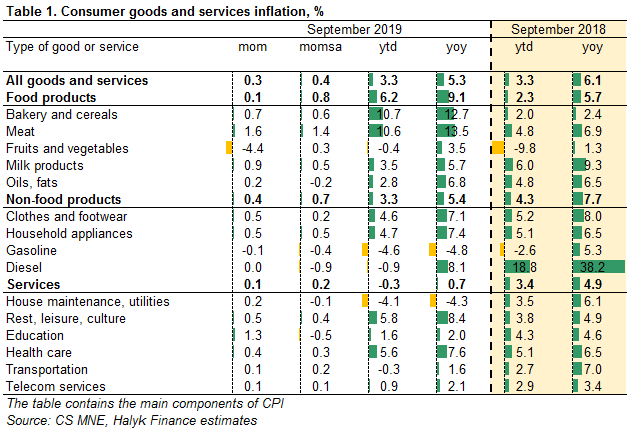

According to the Committee on Statistics, inflation in September rose slightly by 0.3% after 0.2% throughout the summer. In annual terms, inflation fell by 0.2pp to 5.3%. Given the seasonal correction (sa), in our estimation, inflation was 0.4% mom, showing the weakest growth since March.

According to the results of September, inflation in the food products group kept the growth rate at 0.1% for the third month in a row, 0.8% mom sa, providing 0.04pp in the total inflation. High prices are supported by bakery products and cereals, meat, dairy products, and eggs. There was a decline in prices for the fruits and vegetables, sugar. Prices for non-food products increased by 0.4% mom (0.1% mom sa), a contribution of 0.1pp to inflation. The cost of clothes and shoes, household appliances, and medicines has increased. In the service sector, tariffs increased by 0.3% mom (+0.2% mom sa) with a 0.09pp contribution to price changes. The main factors of increase: rental housing services, healthcare, personal services, recreation and entertainment. Air transport services became cheaper.

Our opinion

Inflation in September interrupted the trend of accelerating price increases observed since the end of the first quarter. The main drivers of accelerating price increases - food products showed a slowdown, although the rise in prices for bread, milk and meat remains quite high. Since the beginning of the year, the price increase amounted to a moderate 3.3%, which corresponds to the same indicator last year. The situation in the foreign exchange market was relatively stable - in September, the tenge weakened against the US dollar by only 0.3 tenge, over nine months the tenge weakened against the ruble by 6.5% yoy (5.9 vs 5.4), against the US dollar the weakening was stronger at -12% yoy (381 vs 336). An increase in the base rate by the regulator in September by 0.25pp, in our opinion, will help stabilize inflation expectations. As part of the National Bank’s further efforts to manage inflation expectations and maintain tenge positions, it is possible that the regulator may make another rate increase before the end of this year, all the more so since inflation risks have not disappeared. Moreover, there are regulatory factors regarding the control of trade turnover within the EAEU, which will put some pressure on prices in the short term. Nevertheless, despite the risks, we believe that inflation will continue moving within the 4-6% corridor this and the next year.