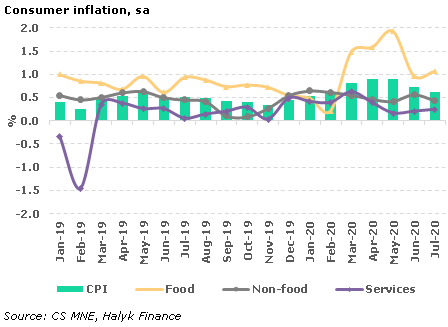

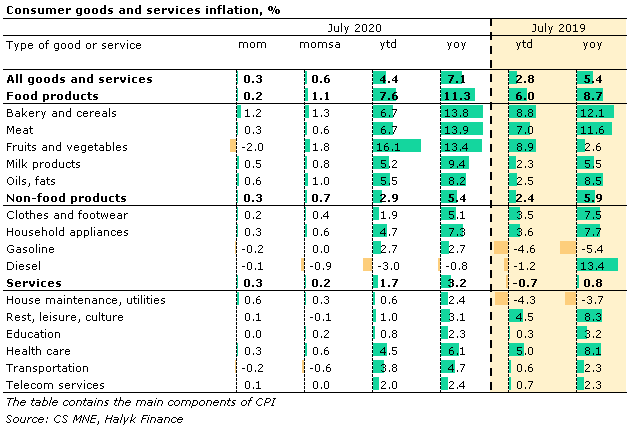

According to the Committee on Statistics, inflation in July slowed down to 0.3% mom from 0.4% mom in the previous month. In annual terms, the growth in prices slightly accelerated from 7% to 7.1%. Taking into account the seasonal adjustment (sa), inflation eased to 0.6% mom from 0.7% mom according to our estimates.

The change in prices for food products in July amounted to 0.2% mom (+1.1% mom sa), providing 0.2 pp in headline inflation. Prices for cereals went up (+4.7% mom), oils and fats (+0.6% mom), lamb (+1% mom). The prices for fruits and vegetables decreased (-2% mom) and eggs (-2.4% mom).

Prices for non-food products increased by 0.3% mom (+0.4% mom sa), providing a 0.1pp contribution to inflation. The cost of antiseptics (+2% mom), paints (+1.5% mom), detergents and cleaning products (+0.8% mom), medicines (+0.7% mom) increased. The cost of gasoline and diesel fuel decreased (-0.2% and -0.1% mom).

In the service sector, tariffs increased by 0.3% mom (+ 0.2% mom sa), contributing to the price increase of 0.06pp. Increased tariffs for cold water (+3.1% mom), garbage collection (+1.9% mom), funeral services (+3.2% mom). Transport services fell in price (-0.2% mom).

Our view

July inflation slowed slightly for the third month in a row. Seasonally adjusted inflation has also declined. At the same time, the inflation rate for 7 months of this year is significantly higher than the inflation rate for the same period last year - 4.4% versus 2.8%. This acceleration is mainly due to double-digit growth in food prices and higher tariffs for services, while prices for non-food products are showing a comparable growth rate as in the previous year. Amid the economic crisis, growth in real wages in June went into negative territory for the first time this year. We believe that the decline in real wages will continue in the second half of the year, which, together with a significant increase in hidden unemployment (self-employed, temporarily unemployed), will restrain pressure on inflation. We maintain our end-of-year inflation forecast at 7.3% yoy (link to report: We expect decline of rates in tenge and recommend buying bonds of the Ministry of Finance with a maturity of 3-5 years)