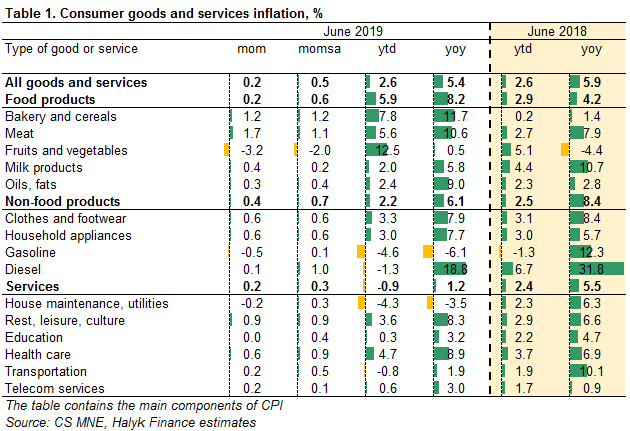

According to the Statistics Committee, inflation weakened in June to 0.2% from 0.5% in May. In annual terms, it was 5.4%, the highest level since October 2018. Taking into account the seasonal adjustment (sa), by our estimate, inflation was 0.5% mom. Rise in prices weakened slightly against the background of lower prices for vegetables and a slight slowdown in the group of non-food products.

In the group of food products, inflation in June was 0.2%, 0.6% mom sa, providing 0.08pp in total inflation. High price increases are preserved for bakery products and cereals, which increased in price by 1.2% mom, rice went up by 4.1% mom, flour by 1.4% mom, pasta by 1% mom, meat by 1.7% mom, fruits for the month added 1.8%. There was a decrease in prices for eggs (-6.1% mom), vegetables (-6.9% mom), sugar (-1.4% mom).

Prices for non-food products increased by 0.4% mom (0.7% mom sa), providing a contribution of 0.12pp to inflation. The cost of clothing and footwear (+0.6% mom), textiles (+0.7% mom), medicines (+0.6% mom), household appliances (+0.6% mom).

In the service sector, tariffs increased by 0.2% mom (+0.3% mom sa) with 0.06pp in contribution to price changes. The main factors for increase are: healthcare (+0.6% mom), catering services (+0.5% mom), recreation and entertainment (+0.9% mom). Separate utilities became cheaper.

The results of population surveys for May, published by the NBK, showed a slight increase in inflationary and devaluation expectations. The share of respondents who expect price growth to accelerate in the next 12 months increased to 21.9% in May after 18.6% in April (17.6% in May 2018, 28.2% at its peak in September 2018). The share of respondents expecting a decline or unchanged price position increased to 10.6% from the previous month, after 9.6% in April (9.9% in May 2018), with a minimum of 5.8% in October 2018. In May 2019, the share of respondents who expected a rise in the US dollar rose to 65.7% compared to 65.3% in the previous month (53.2% in May 2018), which is below 70.7% at its peak in September 2018 At the same time, the amount of net expenses of the population for the purchase of cash dollars in January-May increased by 78% compared to the same period of 2018 to T555.3 billion.

Our opinion

Despite a slight weakening in food and non-food prices, the seasonally adjusted figures indicate that inflationary pressure remains. The weakening of the national currency became systematic, for example, against the US dollar, the tenge weakened by 3% from the beginning of the year and by 14% for the first half of the year, against the ruble over the same periods, the weakening was 7% and 5%, respectively. The effect of the administrative reduction in the cost of housing and communal services at the beginning of this year is gradually disappearing. The cost of fuel is still at a low level, which leads to an imbalance in prices in the domestic fuel market in comparison with neighboring Russia, where prices for diesel and gasoline are above T250 in tenge per liter or 30% -40% more than local prices. Increased wages and numerous other social initiatives of the government, as well as high inflation and devaluation expectations create the basis for inflationary pressure. In addition, food prices on the world market are steadily rising, and the prospects for harvest in some large countries producing agricultural products are rather negative due to weather conditions. In our opinion, given the numerous inflation risks and the uncertainty of external macroeconomic factors, in the near future the regulator will probably refrain from any actions related to the base rate.