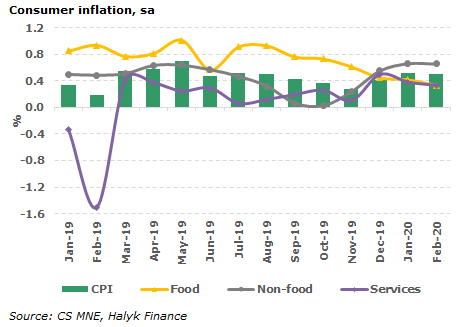

According to the Committee on Statistics, February inflation slowed to 0.6% from 0.7% in the previous month, in annual terms there is an increase from 5.6% to 6%, which is the highest level since October 2018. Given the seasonal adjustment (sa), by our estimate, inflation did not change and amounted to 0.5% mom.

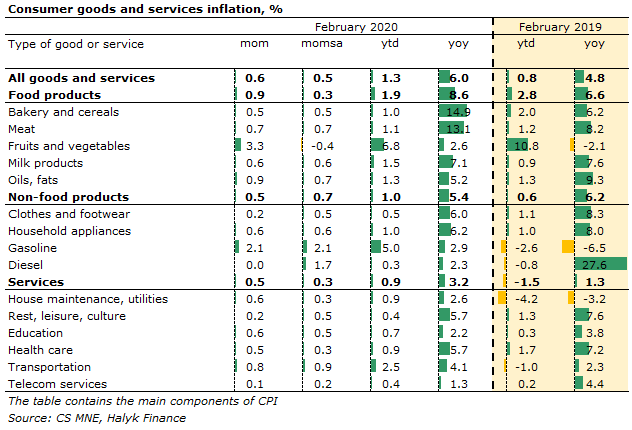

According to the results of February, inflation in the food product group amounted to 0.9% mom, (0.3% mom sa), providing 0.35pp in the total inflation. Fruits and vegetables rose in price (+3.3% mom), oil and fats (+0.9% mom), meat (+0.7% mom). The decrease in prices occurred for eggs (-1.6% mom), rice (-0.7% mom), sugar (-1.5% mom). Prices for non-food products increased by 0.5% mom (0.7% mom sa), providing a 0.15pp contribution to inflation. The cost of household goods increased by (+0.5% mom), cars (+0.5% mom), but the main growth was in gasoline (+2.1% mom; +5% in January-February). In the service sector, tariffs rose by 0.5% mom (0.3% mom sa), with 0.15pp contribution to price increases. The main factors behind the increase were garbage collection tariffs (+4.9% mom), electricity (+2.1% mom), health care (+0.5% mom), transport services +0.8% mom.

Our opinion

Year to date inflation shows a marked increase to 1.3% compared with 0.8% for the same period in 2019. As we expected gradual “unfreezing” of tariffs for housing and communal services is the main driver of price growth – housing and communal services grew by 0.9% against a decrease of 4% a year earlier, the cost of gasoline increased by 5%, against a decrease of 2.6%, respectively.

The increase in the annual inflation rate to 6% was influenced by the low base of last year, when the inflation level in February-April went below the 5% mark. So it is likely that inflation may linger at around 6% YoY in March and April of this year, after which it again drops below 6%. Against the backdrop of high inflation expectations of the population and the external adverse situation in the world caused by the spread of coronavirus, we believe that the regulator will leave the base rate unchanged at its current level of 9.25% at the upcoming meeting in mid-March.