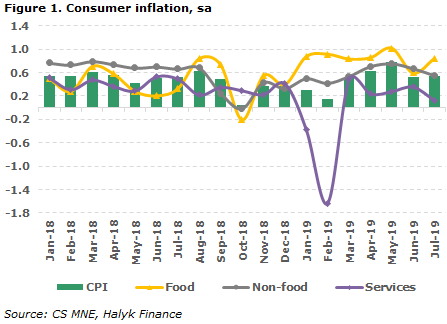

According to the Statistics Committee, inflation in July remained at the level of the previous month at 0.2%. In annual terms, it also stayed unchanged at 5.4%. Taking into account the seasonal adjustment (sa), according to our estimates, inflation was 0.5% mom, showing a consistently higher growth rate compared to the actual one since April.

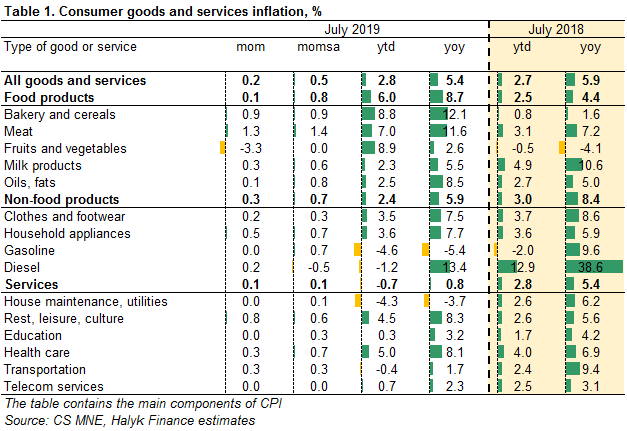

In the group of food products, inflation in July slowed to 0.1%, 0.8% mom sa, providing 0.04pp in total inflation. High price increases are supported by bakery products and cereals, which increased in price by 0.9% mom, cereals went up by 1% mom, meat by 1.3% mom, non-alcoholic beverages added 0.8% in a month. There was a decrease in prices for eggs (-2.5% mom), fruits and vegetables (-3.3% mom) sugar (-1.6% mom).

Prices for non-food products increased by 0.3% mom (0.6% mom sa), the contribution of 0.09pp in inflation. The cost of footwear (+0.4% mom), household appliances (+0.5% mom), household goods (+0.3% mom). Gasoline has ceased to turn cheaper, while diesel fuel has risen in price by 0.2% mom.

In the services sector, the tariffs increased by 0.1% mom (+0.1% mom sa) with 0.03pp contribution to price changes. The main factors for the increase are: air transport services (+5.2% mom), healthcare (+0.3% mom), personal services (+0.9% mom), recreation and entertainment (+0,8% mom). In the services sector, only hot water got a little cheaper.

The results of population polls for June, published by the NBK, showed an increase in inflationary and devaluation expectations. The share of respondents who expect price growth to accelerate in the next 12 months increased to 24.3% in June, after 21.9% in May (18.9% in June 2018, 28.2% at its peak in September 2018). The share of respondents expecting a decline or unchanged price position did not change from the previous month by 10.6% (8.5% in June 2018), with a minimum of 5.8% in October 2018. In June 2019 the share of respondents who expected a rise in US dollar rose to 67.1% compared to 65.7% in the previous month (49.9% in June 2018), which is slightly lower than 70.7% at the peak in September 2018. The net spending of the population for the purchase of cash dollars in January-June increased by 140% in comparison with the same period of 2018 to T939.4 billion. June was a record month, the population acquired more than $1 billion net, ($200-300 million in June 2017-2018), which is the highest since July 2015, we note that then the dollar was worth about two times cheaper at 187 tenge per USD.

Our opinion

Foodstuffs confidently retain their place as a key driver in price increases. Since the beginning of the year, there has been a strong increase in prices for bakery products and cereals +8.8% (+0.8% for 7M2018), fruits and vegetables +8.9% (-0.5% for 7M2018), meat +7% (+3.1% for 7M2018). The overall price index has also overtaken last year’s level at 2.8% since the beginning of the year (+2.7% over 7M2018), and this despite the decline and freezing of utility tariffs and the regulation of fuel prices. Prices for non-food products continue to ignore the weakening of the national currency, so, against the US dollar, the tenge weakened by 13% yoy for 7M2019 and 3% from the beginning of the year, against the ruble in the same period, the weakening was 6% yoy and 9%, respectively. For the time being, the National Bank keeps the base rate at 9%, but the yields on 1-month notes have already increased by about half a percent to 9.1% from May, by more than 1pp to almost 10% for semi-annual and annual notes. If the yield growth goes above 10% (the upper limit of the interest rate corridor), we can expect an increase in the base rate from the regulator. In our opinion, against the background of the established inflationary picture, inflationary risks will continue to increase, which may cause another surge in inflation this fall.