In the third quarter of 2025, Kazakhstan’s economy maintained positive momentum, although growth is gradually slowing. GDP growth for the first nine months of 2025 amounted to 6.3% yoy, compared with 6.5% yoy in January–August, reflecting a slowdown across all key sectors. Expansion of oil production at the Tengiz field remains the main driver of industrial output and overall GDP. The impact of short-term factors, including large-scale public infrastructure spending and substantial monthly transfers from the National Fund to the budget, is gradually waning. Despite strong GDP growth, real household incomes continue to decline.

Fiscal policy in 2025 remained expansionary; however, in 2026, the government plans almost a twofold reduction in transfers from the National Fund, which will weaken the fiscal impulse. The increase in budget expenditures will be financed mainly by higher tax revenues, which does not constitute fiscal or pro-cyclical stimulus.

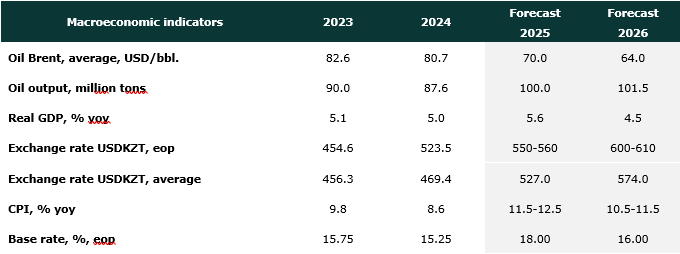

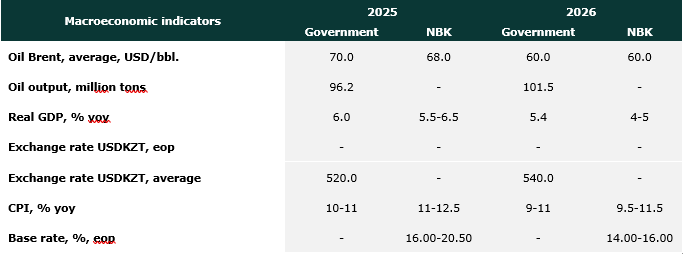

Inflation reached 12.9% yoy in September, marking the highest level this year. In response, the National Bank sharply raised the base rate to 18.00% in October. Such a sharp tightening of monetary policy may slow domestic demand and credit activity while exacerbating macroeconomic imbalances. Due to the acceleration of inflation in September, we revised our end-2025 inflation forecast to 11.5–12.5% yoy. By the end of 2026, inflation is expected to ease to 10.5–11.5% yoy.

The tenge weakened to 549 KZT per USD by the end of September, reflecting higher imports and limited liquidity in the foreign exchange market. At the same time, fundamental factors remain stable: oil prices are holding around USD 69 per barrel, and oil exports continue to increase. We forecast the tenge to depreciate to 550–560 KZT per USD by end-2025 and to 600–610 KZT per USD by end-2026 amid external risks and domestic pressures.

We maintain our GDP growth forecast for 2025 at 5.6%, expecting a gradual slowdown toward year-end due to the weakening of fiscal stimulus and the high base effect from 2024. In 2026, we forecast economic growth to slow further to 4.5%, reflecting the expected decline in oil prices, slower oil production growth, reduced National Fund transfers, higher tax rates, weaker household income dynamics, slower consumer lending, persistent inflation, and the completion of several large public infrastructure projects. Overall, Kazakhstan’s economy is entering a cooling phase following a period of strong growth driven by fiscal spending and oil-sector expansion.

The economy began to cool down

Kazakhstan’s economic growth has started to slow: over the first nine months of 2025, GDP grew by 6.3% yoy, compared with 6.5% yoy in January–August. The short-term economic indicator fell to 9.1% yoy (from 9.6% yoy in January–August). Overall industrial output grew 7.4% yoy, primarily due to the oil sector, which contributed most of the increase in the mining industry (+9.3% yoy). Oil production reached 75.7 million tons in the first nine months and will likely exceed 100 million tons by the end of the year, supported by expansion at the Tengiz field (government plan – 96.2 million tons). The manufacturing sector grew 6.2% yoy, supported by machinery and food production, while metallurgy stagnated. The trade sector rose 8.8% yoy, but growth began to slow due to weaker wholesale activity. Retail trade maintained moderate growth (+7.1% yoy), although its sources are unclear given the decline in real household incomes (–1.0% yoy in H1) and the cooling of consumer credit. The transport sector showed slower but still strong growth (+21.2% yoy) due to state infrastructure projects and cargo turnover expansion. The construction sector grew 14.9% yoy, with slower dynamics in structural and residential building.

We maintain our 2025 GDP growth forecast at 5.6%. Current growth is driven by oil-production expansion, the low base effect from 2024 (GDP grew 4.1% yoy in 9M 2024), and substantial National Fund (NF) transfers to the republican budget in late 2024 and the first half of 2025. Large-scale public infrastructure investments continue to support growth but are gradually losing momentum. Without additional National Fund transfers in Q4 (as in 2024), the high base from late 2024 will lead to slower GDP growth by year-end. Another constraint could come from the sharp increase in the National Bank’s (NBK) base rate.

We forecast that in 2026 Kazakhstan’s GDP growth will slow to 4.5% yoy (the government forecast is 5.4% yoy). The expected oil-price decline (USD 64 per barrel on average in 2026) will constrain export and fiscal revenues. Meanwhile, oil production will not increase as significantly as in 2025, when the Future Growth Project (FGP) at Tengiz provided a strong boost. Additional headwinds include reduced fiscal stimulus (National Fund transfers to decline to KZT 2.77 trillion from KZT 5.25 trillion in 2025), higher tax rates, slower consumer credit, persistently high inflation, weak household income growth, and the completion of several major infrastructure projects. The high 2025 base will also weigh on the 2026 results.

Fiscal stimulus reduction

For the first nine months of 2025, state budget revenues excluding transfers increased by 15.8% yoy, reaching KZT 17.3 trillion. The main growth driver was tax revenues (+20.0% yoy), particularly due to increases in CIT (+24.9% yoy), VAT (+20.3% yoy), PIT (+16.9% yoy), customs duties (+16.7% yoy) against a low base from the previous year. Non-tax revenues, by contrast, declined 28.4% yoy due to the absence of large one-off dividend inflows from state-owned shareholdings, as seen in 2024. Meanwhile, revenue execution for the republican budget over the first nine months of 2025 reached 94.4%, raising concerns regarding fiscal performance in 2026.

State budget expenditures rose 10.4% yoy to KZT 22.9 trillion. The main spending categories were education (21.9%), social assistance (21.8%), and utilities (7.2%). The share of expenditures on public debt servicing increased from 8.8% in 2023 to 10.2% in 2025.

As of end-September 2025, National Fund assets stood at KZT 35.8 trillion, up 14.2% yoy. However, inflows into the NF decreased 4.0% yoy to KZT 5.3 trillion, mainly due to lower tax payments from the oil sector, including CIT (–10.1% yoy), rent tax (–28.9% yoy), and additional subsoil user payments (–34.9% yoy). Meanwhile, withdrawals from the NF totaled KZT 4.2 trillion (+4.1% yoy). Excluding investment income, withdrawals exceeded inflows by KZT 1.4 trillion, despite the average oil price of USD 71 per barrel over the period. The figures indicated also exclude withdrawals in the form of bonds.

The draft republican budget for 2026–2028, published in late August 2025, provides for a reduction in guaranteed transfers from the National Fund to KZT 2.77 trillion and the abolition of targeted transfers, implying a nearly twofold decrease in fiscal stimulus (compared with KZT 5.25 trillion in 2025, assuming no additional withdrawals).

Sharp base rate increase

In September 2025, inflation accelerated to 12.9% yoy, marking the highest level of the year. The main contributors to price growth were food products (5.23 p.p.; +12.7% yoy), followed by paid services (4.47 p.p.; +15.3% yoy) and non-food goods (3.23 p.p.; +10.8% yoy). In our view, the inflation acceleration this year was driven by the growth of regulated housing and utility tariffs, including electricity, gas, and water, which had a multiplicative effect on overall prices; the excessive use of National Fund resources in the fourth quarter of 2024 and the first half of 2025; the depreciation of the tenge in the beginning of the year and in July; the appreciation of the Russian ruble since March, which increased imported inflation in Kazakhstan, particularly for food; as well as persistently high inflation and devaluation expectations among households and businesses.

Monthly inflation in September amounted to 1.1%, significantly higher than last year’s 0.4%, and not attributable to seasonality. On a quarterly basis, prices rose 2.8% in the third quarter of 2025 compared with 1.6% in the same period of 2024, highlighting persistent inflationary pressure.

Against this backdrop, on October 10, the National Bank increased the base rate by 150 basis points, from 16.50% to 18.00%, explaining this move as necessary to stabilize inflation expectations and prevent a potential inflationary spiral. This was the second sharp rate hike of 2025: in March, the NBK had already raised the rate by 125 basis points to 16.50%. However, the latest press release did not explain why the March tightening failed to address inflation’s underlying causes, which remained largely unchanged by October.

In our view, the NBK’s reaction was excessive, as most current inflation drivers — fiscal stimulus, tariff increases, and exchange rate volatility — cannot be resolved through monetary tightening. Several existing regulatory and government measures already create disinflationary effects, such as the freeze on utility tariffs until year-end, tighter reserve requirements for banks, enhanced supervision of consumer lending, and a significant reduction of fiscal stimulus. These factors alone should contribute to moderating inflation toward year-end, even without such a steep rate hike.

Applying standard inflation-targeting principles, we believe that in October the NBK should have raised the base rate by no more than 50 basis points, as a stronger increase risks amplifying macroeconomic imbalances and undermining confidence in monetary policy.

Taking into account the current price dynamics and implemented anti-inflationary measures, we have revised our end-2025 inflation forecast to 11.5–12.5% yoy. By end-2026, inflation is projected to decline to 10.5–11.5% yoy. Price pressures in 2026 will persist due to planned tariff increases, tenge depreciation, and tax changes, including the effect of higher VAT, but inflation should ease in the second half of the year as these effects fade, the 2025 high base takes hold, domestic demand cools amid credit restrictions and high interest rates, and real income growth slows.

The national currency weakened

The USD/KZT exchange rate stood at 549.07 KZT per USD at the end of September, weakening by 1.9% over the month and by 5.6% compared with June. The average exchange rate for the third quarter weakened to 536.05 KZT per USD versus 513.77 KZT per USD in the second quarter. The main pressure on the tenge occurred in July and September, while in August the national currency showed temporary strengthening due to seasonal inflows of export revenue and slower investment activity.

The depreciation of the tenge occurred amid stable fundamentals. Oil prices remained around USD 69 per barrel, oil exports continued to grow, and the U.S. dollar index stayed low. Pressure on the exchange rate mainly resulted from higher imports associated with large infrastructure projects, which increased demand for foreign currency. In addition, heightened activity of certain market participants against a backdrop of shallow market depth and limited liquidity amplified volatility.

In late July, the NBK conducted its first foreign exchange interventions since the end of 2024, totaling USD 125.6 million, in response to speculative demand for foreign currency. In August, the exchange rate stabilized, but in September the tenge weakened again, while the regulator refrained from further interventions. According to the NBK, net foreign currency sales on the exchange in September amounted to USD 1.04 billion. The practice of “mirroring operations” with gold and the requirement for mandatory sale of 50% of foreign currency earnings by quasi-state entities continued. Purchases of foreign currency for the Unified Pension Fund (UAPF) have been suspended since August.

We forecast the tenge exchange rate to reach 550–560 KZT per USD by the end of 2025, reflecting gradual depreciation driven by import growth and reduced monthly foreign currency sales from the National Fund (in the absence of additional transfers). On the other hand, oil prices are expected to remain near current levels, and oil exports should continue to rise. At the same time, the volume of sterilization operations under gold-mirroring schemes will increase substantially: in the fourth quarter, about KZT 1.4 trillion (equivalent to USD 848 million per month) in foreign currency sales are planned. These operations will offset the decline in National Fund sales, increasing foreign currency supply and helping to stabilize the tenge.

In 2026, further depreciation of the national currency to 600–610 KZT per USD is expected, assuming other factors remain unchanged. The main drivers will be a decline in global oil prices, reduced export earnings, and a lower volume of foreign currency sales from the National Fund, which will deepen the imbalance between supply and demand in the domestic FX market.

Halyk Finance forecasts

Government and NBK forecasts

Analytical center

Citation of the original source is required when using material from this publication.