In the first half of 2025, Kazakhstan’s economy demonstrated notable acceleration. GDP growth reached a record 6.2% yoy, driven by strong expansion in the transport, construction, mining, and manufacturing sectors. Growth was further supported by a significant increase in oil production, the implementation of large-scale infrastructure projects, and expansive fiscal spending. Despite the solid GDP performance, improvements in household welfare remain limited — real incomes continue to show subdued or even negative dynamics.

Fiscal policy remains expansionary: budget revenues increased amid higher tax inflows, while expenditures also continued to grow. The National Bank’s international reserves and the National Fund’s foreign assets expanded. However, budget transfers from the National Fund remain elevated even as oil-related tax receipts decline.

Inflationary pressures intensified in H1 2025: by June, annual inflation reached 11.8% yoy, with the largest contribution coming from paid services. Reflecting this, our year-end inflation forecast has been revised upward from 10% to 10–11%. The National Bank of Kazakhstan (NBK) is expected to maintain the base rate at 16.50% through year-end — in line with our view.

The tenge strengthened modestly in the first half of the year amid supportive FX operations. We expect a gradual depreciation to 550–560 KZT per USD by year-end, reflecting external risks and domestic imbalances.

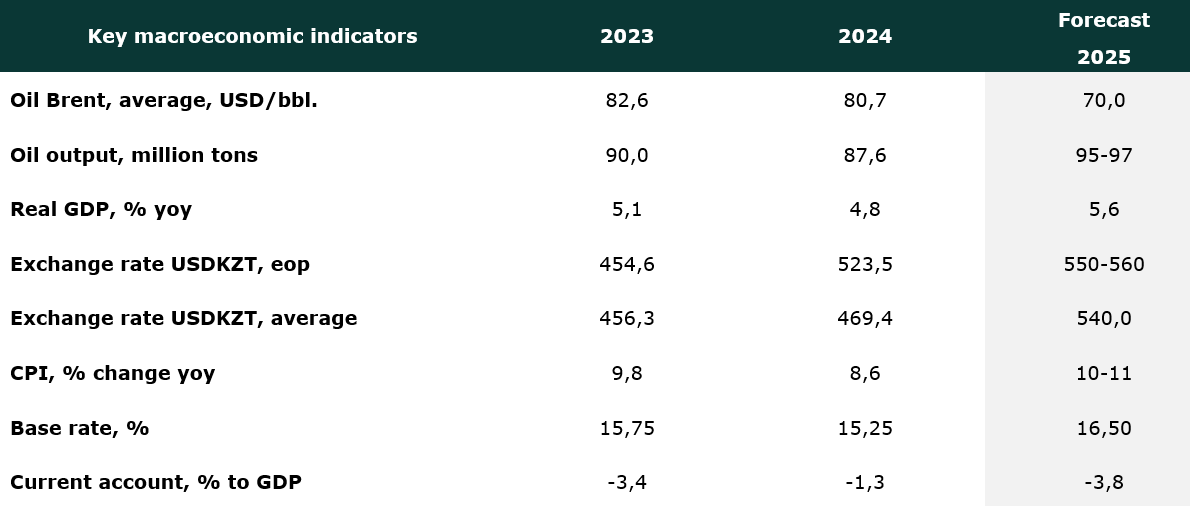

Given the strong performance across major sectors, we have revised our 2025 GDP growth forecast upward to 5.6% (from 5.3% previously). The main growth driver will remain the expansion of oil output, supported by state-financed infrastructure projects. The forecast assumes an average Brent oil price of USD 70/bbl. At the same time, several headwinds persist — including tight monetary conditions, oil price volatility, and global trade uncertainty. The low-base effect from 2024 is also expected to fade by year-end.

Executive summary

Economic growth accelerated in H1 2025

In the first half of 2025, Kazakhstan’s economy recorded significant acceleration: according to preliminary government estimates, real GDP grew 6.2% yoy (compared to 3.2% yoy in H1 2024). The Short-Term Economic Indicator (STEI) reached a multi-year high of 9.0% yoy. Key growth drivers were the transport and construction sectors, where government infrastructure spending ensured robust expansion of 22.7% and 18.4%, respectively. Industrial output rose 6.5% yoy, supported by increased oil production under the Future Growth Project (FGP) at the Tengiz oil field. The manufacturing sector showed slower growth of 5.5% yoy, mainly due to weaker dynamics in ferrous metallurgy. The trade sector, after slowing early in the year, rebounded to 8.4% yoy growth.

We have raised our 2025 GDP growth forecast to 5.6% (previously 5.3%), considering the current economic momentum. The main driver will be the increase in oil production at the Tengiz field. Large-scale engineering and transport infrastructure projects and continued fiscal stimulus will also support growth. However, risks remain — notably tight monetary conditions, global uncertainty, and oil price volatility. Excluding the extractive sector, GDP growth for 2025 is expected to be more moderate at around 3.5%, constrained by sluggish productivity and investment growth. Our forecast assumes an average Brent price of USD 70/bbl.

Fiscal policy remains expansionary

Kazakhstan continues to pursue an active fiscal expansion. According to data from the Ministry of Finance (MoF), by end-June 2025 total state budget revenues amounted to KZT 14.5 trillion, an increase of 17.6% yoy or KZT 2.2 trillion. The rise was mainly driven by tax revenues, which grew 20.4% yoy (up by KZT 1.8 trillion), while non-tax revenues declined slightly by 1.1% yoy. Budget expenditures also increased, up 15.2% yoy. Fiscal spending continues to be supported by transfers from the National Fund (NF), which accounted for 21.5% of total budget revenues. The volume of transfers also rose year-on-year — from KZT 2.75 trillion in H1 2024 to KZT 3.12 trillion in January–June 2025 (+13.5% yoy).

As of end-June 2025, NF assets stood at USD 60.3 billion, increasing by 2.5% since the beginning of the year. According to the National Bank of Kazakhstan (NBK), this growth was driven mainly by strong investment income. However, according to MoF, NF recorded an investment management loss of KZT 584 billion in Q1 2025. The discrepancy between NBK and MoF data raises questions regarding differences in reporting periods and accounting methodologies. Inflows to NF during H1 2025 amounted to KZT 1.2 trillion, which is 56% lower than in the same period last year (KZT 2.8 trillion). The main reason for the decline in inflows was a reduction in direct taxes from oil sector companies — from KZT 2.3 trillion to KZT 1.8 trillion — reflecting lower oil prices. As a result, there was a net outflow of around KZT 1.9 trillion. The accelerated use of NF transfers creates risks for Kazakhstan’s financial stability and long-term economic sustainability. Persistent reliance on NF to finance short-term fiscal needs reduces its stabilizing role. In addition, current global market volatility and the projected decline in oil prices could lead to lower investment income of NF, which currently covers a large share of the gap between withdrawals and inflows.

Tight monetary policy conditions persist

In the first half of 2025, inflationary pressures intensified. In January, annual inflation stood at 8.9%, rising to 11.8% in June (11.3% in May). The main drivers were higher utility tariffs, fiscal stimulus, and the weakening of the tenge at the end of 2024 and in January 2025, which increased imported inflation.

Monthly inflation, which peaked in February–March (1.5% and 1.3%, respectively), gradually slowed. In June it stood at 0.8% (0.9% in May), while the growth rate of service prices declined significantly, in line with our expectations.

The base rate, which the NBK raised from 15.25% in January to 16.50% in March, has remained unchanged since then. According to the regulator, this decision was based on updated inflation and GDP growth forecasts, as well as the results of risk assessments and data analysis.

External and domestic pro-inflationary factors persist, including the high level of NF transfers, exchange rate volatility, and lower oil prices. The largest contribution to price growth came from paid services (mainly due to higher regulated tariffs for housing and utilities) and non-food goods, reflecting the high import share in consumption, fluctuations in global commodity prices, and limited potential to expand domestic supply. A key challenge for monetary policy effectiveness remains the procyclical nature of fiscal spending, which supports aggregate demand even under tight monetary conditions. Substantial government expenditures offset the effect of the high base rate, emphasizing the need for better coordination of macroeconomic policies.

Taking these factors into account, we expect annual inflation to remain within the range of 10–11% by the end of 2025, with a high likelihood of approaching the upper bound. Based on NBK statements, the base rate is expected to remain at 16.50% through the end of the year. In the longer term, returning inflation to target levels will require not only a tight monetary policy but also structural measures aimed at diversifying production and smoothing fiscal cycles.

National currency strengthened

Kazakhstan’s foreign exchange market in 2025 remained influenced by mixed internal and external factors. On the one hand, the tenge was supported by significant foreign currency sales from NF and proceeds from gold exports, which helped to smooth short-term volatility amid strong import demand. On the other hand, pressure persisted due to imports exceeding export revenues. For the first five months of 2025, imports grew by 2.2% yoy, while total exports fell by 9.2% yoy in nominal terms.

By the end of June, the exchange rate stood at 520.4 KZT per USD, compared with 523.5 KZT per USD in December. The main factors supporting the tenge since the beginning of the year included NF foreign currency sales of USD 4.95 billion, mirrored gold operations, mandatory conversion of foreign currency earnings by quasi-sovereign companies, and a temporary suspension of FX purchases for the Unified Pension Fund (UAPF) in January–February. The weakening of the tenge to around 540 per USD in July is viewed as temporary and not reflective of underlying fundamentals. We expect the NBK to take appropriate measures to stabilize the situation.

Current measures are aimed at stabilizing short-term volatility in the domestic currency. However, the exchange rate remains sensitive to global market conditions, including oil and metal prices, geopolitical risks, and the exchange rate policies of key trading partners. As Kazakhstan is a small open economy with a relatively shallow FX market, any significant imbalance between foreign currency demand and supply can lead to deviations from fundamental levels. In baseline scenario, we expect the tenge to gradually depreciate toward 550–560 per USD by the end of 2025. This forecast assumes an average oil price of USD 70 per barrel and annual oil exports of around 95–97 million tons.

Halyk Finance forecasts

Analytical center

Citation of the original source is required when using material from this publication.